Contagion: Banking Collapse-Collateral Damage

The Ripple Effects Are Being Felt Worldwide-Financial Tsunami Incoming

I just realized as I was hitting the button to publish this article there’s another double entendre here. “Collateral”. You’ll get it, I’m sure.

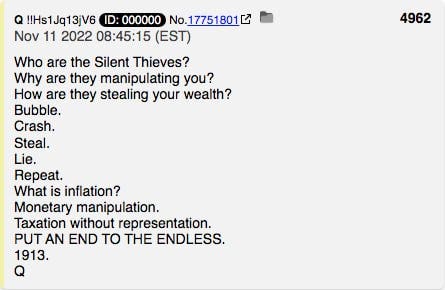

The questions are endless. Hopefully, the answers will be forthcoming. Sometimes you have to tear the old world down to build a new one. “Q” told us “The End Won’t Be For Everyone”. Especially the banksters.

I can’t begin to tell you how many excellent articles, videos and interviews are being written and researched about the banking shenanigans happening worldwide. It’s not like there isn’t a plethora of stupid to chose from with these greedy banksters. It’s truly sad, on so many levels, how many innocent, trusting people will have their entire lives and families devastated by these criminals. The Central Banking Systems worldwide are being exposed for their collusion, confusion and mainly their illusion of being something good for their countries.

Let’s Dive In:

Yellen, Powell and the current occupying regime in D.C. town are all trying to sell that lie that everything is under control. If it is, it’s not their control. We are seeing the systematic destruction of the Central Bank System Worldwide and frankly, I don’t think there’s a damn thing they can do about it. I think they are just like many of us, they wake up every morning to the newest catastrophe and they have to figure out what possible spin they can come up with for the day. You should all catch the 1913 reference. Seems to me someone might have mentioned the necessity for this to happen. It’s right there on the tip of my tongue and I just can’t seem to remember who…..

On Monday morning, trading in the shares of a number of banks was halted as panic spread following the collapse of Silicon Valley Bank.

The Nasdaq Trader website published a list of bank shares that were placed under a temporary regulatory halt. Newsweek has listed them below.

Each bank share had been hit with a volatility trading pause, a kind of circuit-breaker that automatically halts trading for a short time when a share's price swings too rapidly. At the time of writing, some of these shares had plunged by more than 60 percent.

Western Alliance Bancorporation Common Stock (was halted and resumed several times, was down nearly 47% at close of the day)

PacWest Bancorp (was halted and resumed several times, was down 21% at the close of the day)

First Republic Bank Common Stock (was halted and resumed several times, was down nearly 62% at the close of the day)

Zions Bancorporation N.A. (was halted and resumed several times, was down nearly 26% at the close of the day)

OceanFirst Fnl Dp Sh Pfd A - Preferred Stock (trading resumed by 11:50 a.m. ET, was down nearly 14% at the close of the day)

Customers Bancorp, Inc. Common Stock (was halted and resumed several times, was down nearly 24% at the close of the day)

East West Bancorp, Inc. (was halted and resumed several times, was down more than 17% at the close of the day)

Metropolitan Bank Holding Corp. Common Stock (was halted and resumed several times, was down nearly 44% at the close of the day)

First Horizon Corporation Common Stock (was halted and resumed several times, was down more than 20% at the close of the day)

Regions Financial Corporation Common Stock (was halted and resumed several times, was down roughly 7% at the close of the day)

Comerica Incorporated Common Stock (was halted and resumed several times, was down more than 27% at the close of the day)

Bank of Hawaii Corporation Common Stock (was halted and resumed several times, was down more than 18% at the close of the day)

KeyCorp Common Stock (trading resumed at 10:31 a.m. ET, was halted again at 10:33; trading resumed by 10:38 a.m., was down more than 27% at the close of the day)

Customers Bancorp, Inc. 5.375% Subordinated Notes Due 2034 (was halted and resumed several times, was down 18% at the close of the day)

Macatawa Bank Corporation (trading resumed at 9:54 a.m. ET. It was briefly halted again at 9:55 before resuming at 10 a.m., was down 4.5% at the close of the day)

Texas Capital Bnc Dpsh 5.75 Ps - Preferred Stock (trading resumed by 9:57 a.m. ET. It halted again at 9:59 before resuming at 10:09 a.m., down more than 6% at the end of the day)

United Community Bk Dep (trading resumed by 10:03 a.m. ET, was down more than 6% at the end of the day)

The Charles Schwab Corporation Common Stock (was halted and resumed several times, was down more than 11% at the close of the day)

Coastal Financial Corp Cm St (trading resumed by 9:41 a.m. ET, was down nearly 16% at the close of the day)

Huntington Banc Dep Shs J (trading resumed by 9:50 a.m. ET, was down nearly 17% at the close of the day)

Magyar Bancorp Inc. (trading resumed by 9:35 a.m. ET, was down more than 6% at the close of the day)

Macatawa Bank Corporation (trading resumed by 9:54 a.m. ET, halted at 9:55 a.m. before resuming by 10 a.m., was down more than 4% at the close of the day)

Apparently, the public is getting wise to their lies a lot quicker nowadays as they had to halt trading a second time Tuesday on certain bank stocks for fear it would crash the system with the selloffs that are taking place as Newsweek.com reported Tuesday-Bank Shares Trading Halted Again As Fears Of Collapse Deepen.

Rating agency Moody's cuts outlook on U.S. banking system to negative, citing 'rapidly deteriorating operating environment'.

Newsweek also just put out an article that has some information that I had already started writing about for this article. What will the collateral damage be from SVB, along with other banks, and how soon will it start? Immediately. How long will it take for this banking crisis to shake out? I don’t know, but you can count on one thing, the little people will get screwed over and the rich players will be taken care of. Case in point, “Pensions”.

One of my reasons for starting this article, was how quickly we would see the fallout from investments tied to SVB and other banking entities. Especially pensions and supposed stable investments for older and retired Americans. I didn’t realize how that would also affect pension plans worldwide. Here are a couple of articles to get you thinking in this direction.

“Newsweek-Pensions Lose Milions After Bank Collapse”

Here is an excellenet interview with the always prescient Mel K and former Blackrock manager Edward Dowd on “The Controlled Demolition of the Financial System by Design”.

JP Morgan, Wells Fargo, Credit Suisse and others are also in deep trouble.

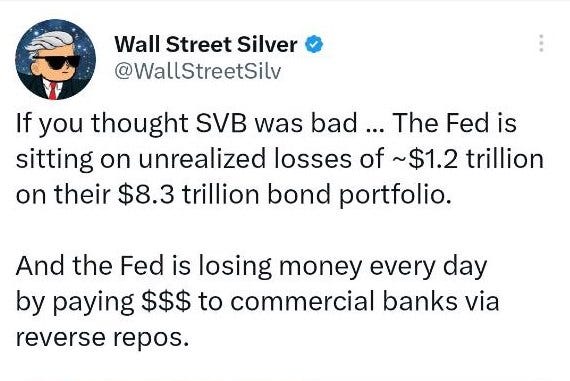

JP Morgan has $28 Billion in cash, and a whopping $3.37 Trillion in liabilities. That’s less than 1% on their balance sheet. Multiple entities are also predicting the imminent collapse of Wells Fargo & Credit Suisse. SVB was nothing compared to what would happen worldwide if these major players fall.

As with my previous article “Banking Collapse, Black Swan Event, Gold, Silver, Bitcoin. As The Dominoes Fall”, where I let you know that Peter Thiel was able to grab his cash before the collapse, apparently he was not the only one as some other investors may have been given a heads up of the impending doom awaiting the masses. “Israeli Bankers Transferred $1 Billion Out of Silicon Valley Bank Right before Collapse”

There is a ton of information coming out about what the investments were and who the investors are in the Silicon Valley Bank. (and some other affected banks) Just like with all of the money laundering and other nefarious activities happening with Ukraine, it may just be one more White Hat take down of another corrupt piece of the puzzle. As more and more information emerges, I do believe that will prove to be the case.

Some food for thought. We’re not just talking state and local pension plans here. We’re talking major corporate plans, complete industries have much of their entire portfolio tied up here. It’s the ripple effect of that liquidity just disappearing, and the panic it evokes in people and their subsequent behavior. Also think about the devastation to the insurance industry that has to start covering these policies for failing banks and institutions. The Power Players manipulating these crashes and the management of these institutions need to be held accountable. It may just be another day at the office for them because they have already secured their future with all that stolen money. That being said, I have a feeling that we are on the cusp of some really bad news, on all fronts, in the next few days before the upcoming implementation deadline of the previously mentioned ISO20022 Banking Laws that are almost upon us. As this crisis deepens, don’t be surprised to see bail-ins as well as bail-outs for these banks. It will all be sold to the public as a necessity until they can no longer maintain the illusion. They will just add it on the ledger of our already unsustainable almost 32 trillion dollar national debt and tax the hell out of “We The People” for their continued stupidity and criminal activity.

The power players in the banking industry are all circling like vultures for the carrion of all of these failed institutions like SVB. They will tear them to pieces and split up the wealth that was stolen form all of us. The Bank Of England, HSBC and many other overseas entities are picking over that carcass as we speak.

As I’m finishing this article, the headlines just keep pouring in from all over the world. Here’s one more big one that was just sent to me by the aforementioned someone who prompted my ISO20022 article.

Sorry to be the bearer of bad news. It seems to be all that’s out there right now. It’s always darkest before the dawn. Speaking of dawn. Oh no, there’s that pesky sun coming up again before I get to close my eyes. Oh well.

For those of you who have the ability to actually check on your pension plan investment portfolio, you might want to do a little research and consider all of your options. This isn’t financial advice in any way, just a little wake-up call to maybe pay a little more attention as all of that liquidity is sucked out of the system. It’s just like when all of the water on the beach recedes out to sea right before that tsunami wave crushes everything in its path.

As always,

Namaste

Until Next time, when we will delve into …….

If you feel my ramblings have merit, please support my work by subscribing, sharing and/or commenting below. The truth will remain secret unless we tear down the walls to the hidden chambers of history and reclaim our humanity for ourselves and future generations. Peace.

After reading this, depending on your opinions of my blatherings, those wishing to contribute to my ongoing coffee addiction, the “Delusional Therapy Bills” fund for my medical treatments, or if you are not yet comfortable with a paid subscription but you enjoy my work and would like to read more, then please make a one-time donation and buy me a coffee. Your support means so much and will allow me to devote more time to research as we continue on with our journey of enlightenment.